Table of Contents

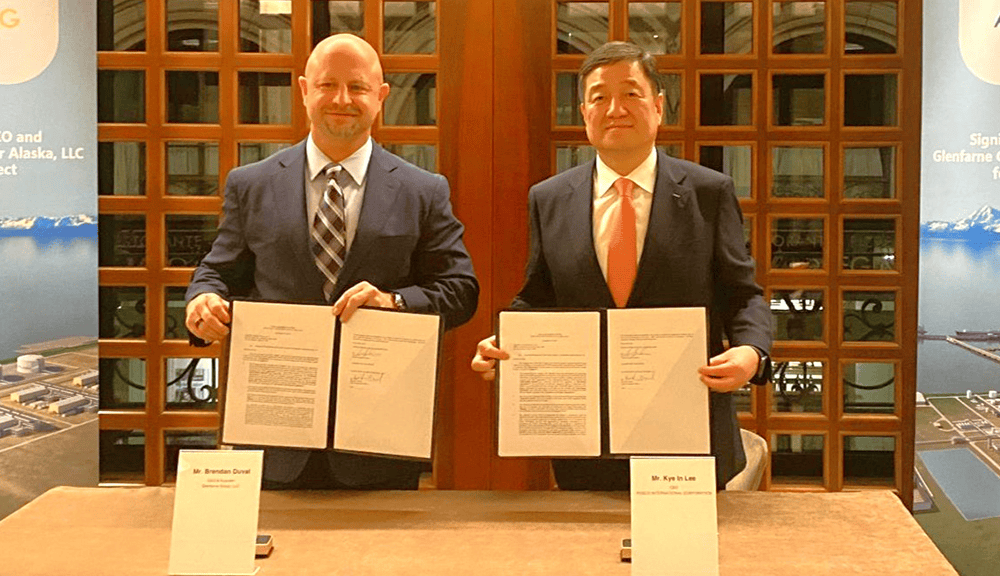

Woodside Energy Group has completed a strategic partnership with Williams by selling a 10% interest in Louisiana LNG LLC and an 80% interest in Driftwood Pipeline LLC to the US natural gas infrastructure company for USD 250 million. The total proceeds amount to USD 378 million, including proportionate capital reimbursement. The transaction, which was simultaneously signed and closed with an effective date of January 1, 2025, represents a key milestone in Woodside's Louisiana LNG strategy.

Williams will contribute approximately USD 1.9 billion toward its share of capital expenditure for the LNG facility and pipeline, while assuming LNG offtake obligations for 10% of produced volumes.

Strategic Partnership Structure

Under the new partnership arrangement, Williams will hold 10% equity in Louisiana LNG LLC (HoldCo), with Woodside retaining the remaining 90%. HoldCo owns 60% equity in Louisiana LNG Infrastructure LLC (InfraCo), with the remainder owned by existing infrastructure partner Stonepeak. Williams will control 80% equity in Driftwood Pipeline LLC (PipelineCo) and manage construction and operations of the Line 200 pipeline to the Louisiana LNG Terminal, while Woodside retains 20% ownership.

The company will utilize its extensive pipeline experience, operating more than 33,000 miles of pipeline across 24 states in the US. The partnership leverages Williams' Sequent Energy Management platform, which has a marketing and optimization footprint of more than 7 billion cubic feet per day. A Williams-led gas supply team, including secondees and oversight from Woodside, will operationalize and optimize daily gas sourcing and balancing according to Louisiana LNG's gas procurement strategy.

Production and Offtake Arrangements

Williams' total share of LNG production from Louisiana LNG will be 1.6 million tonnes per annum. This production will be supplied to Williams under an LNG Sales and Purchase Agreement for approximately 1.5 million tonnes per annum. Williams will also receive the proportionate 10% benefit of Louisiana LNG's existing 1.0 million tonnes per annum agreement previously signed with Uniper.

HoldCo will continue to lead the gas procurement strategy and execute agreements greater than 12 months, while optimization value created through the Sequent platform will be distributed to HoldCo. Williams handles one third of natural gas volumes across the United States through its infrastructure network.

40+ reviews

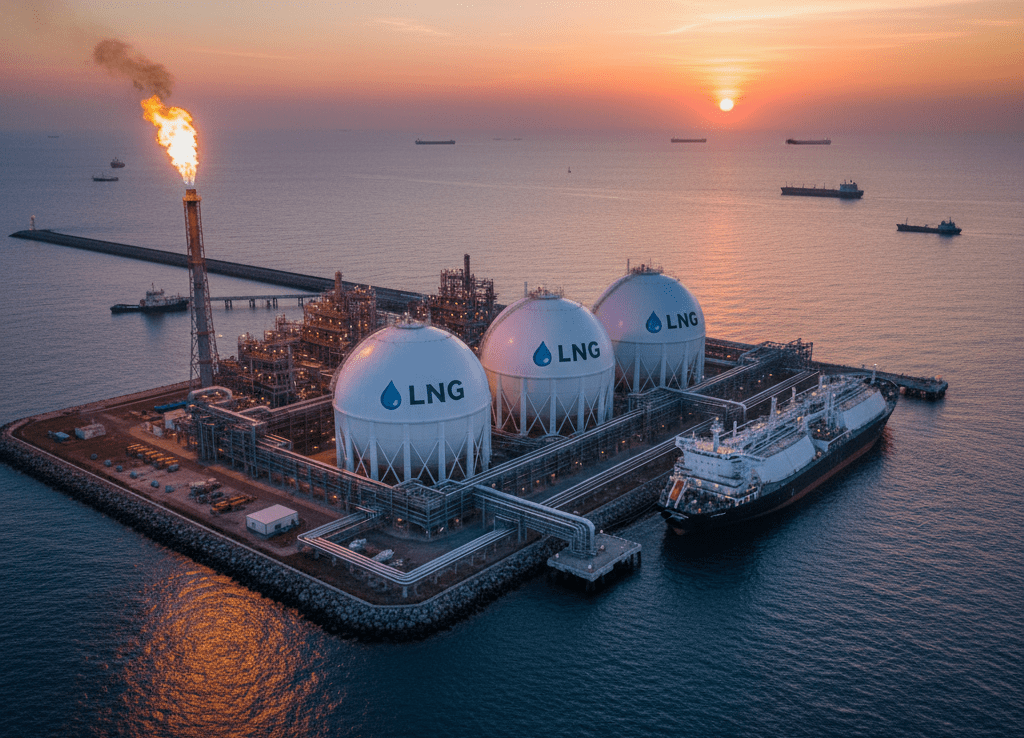

Find the Latest LNG Regasification Plant Projects in United States

Gain exclusive access to our industry-leading database of LNG Regasification opportunities with detailed project timelines and stakeholder information.

Collect Your Free Leads Here!

No credit cardUp-to-date coverage

Joined by 750+ industry professionals last month

Financial Impact and Project Timeline

The transaction has reduced Woodside's total capital expenditure for the Louisiana LNG Project to USD 9.9 billion from USD 11.8 billion at final investment decision. The USD 378 million in total payments from Williams includes a USD 250 million purchase price, which represents Williams' contribution to acquisition and project development costs until the effective date, plus reimbursement of proportionate development costs from January 1, 2025.

HoldCo will remain consolidated in Woodside's year-end accounts, while PipelineCo will be deconsolidated and recorded as an equity investment going forward. The project maintains its target of first LNG delivery in 2029.

Executive Commentary and Project Details

Woodside CEO Meg O'Neill welcomed the partnership, stating: “We are excited to have Williams join us as a strategic partner in Louisiana LNG, given its leadership in US natural gas infrastructure and ability to add value and deliver operational benefits to enhance the project. This is Williams' first investment in LNG, and its participation in Louisiana LNG is a testament to the quality of the project.”

Williams President and CEO Chad Zamarin expressed enthusiasm for the arrangement, saying: “This transaction marks an important step forward in Williams' wellhead to water strategy – integrating upstream, midstream, marketing, and LNG capabilities to deliver the cleanest, most reliable energy to global markets.” Louisiana LNG is a fully permitted project located near Lake Charles, Louisiana, with total permitted capacity of 27.6 million tonnes per annum across five trains.

The approved foundation project includes three trains with a combined capacity of 16.5 million tonnes per annum. Bechtel serves as the engineering, procurement, and construction contractor under a lump sum, turnkey agreement, with the facility utilizing Chart IPSMR liquefaction technology and Baker Hughes LM6000PF+ gas turbines. The partnership brings together Woodside's proven track record in developing and operating LNG facilities with Williams' expertise in pipelines and gas sourcing.

Williams owns and operates energy infrastructure that safely and reliably delivers the natural gas that is used every day to affordably heat homes, cook food and generate electricity. As the world moves to a lower-carbon future, Williams is well-positioned to leverage its natural gas-focused strategy while continuing to deliver consistently stable returns for its shareholders.

Williams is a FORTUNE 500 investment grade corporation headquartered in Tulsa, Oklahoma, with operations across the natural gas value chain spanning the United States. Williams handles one third of natural gas volumes across the United States.

Also Read: NextDecade Announces $6.7 Billion Final Investment Decision for Train 5 at Rio Grande LNG Facility

Connect with Decision-makers about the Latest LNG Regasification Plant Projects in United States for business Opportunities.

Subscribe to our database on LNG Regasification Plant Projects and Tenders in US to get access to reliable and high-quality insights on upcoming, under-construction, and completed LNG Regasification Plant Projects across the world or in your desired geographical location.

Our user-friendly platform provides essential details, timely updates, key stakeholder contact information, and business opportunities tailored for engineering companies, industry professionals, investors, and government agencies.

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.