Loading...

Market Research Reports

|Q4 2024

|Report ID: BR05307

|No. of Pages: 219

About this Report

The global transformer market is currently experiencing a period of significant growth amid high demand as utilities and industries expand power infrastructure to meet rising electricity demand and modernize energy infrastructure for resilience and efficiency.

The outlook for the transformer industry remains highly favorable, with strong, sustained growth expected during the forecast period, supported by increasing demand across a range of voltage levels and applications that span power transformer and distribution transformer deployments.

Some of the major factors driving the market are the aging grid infrastructure, increasing data center buildouts, rising electric vehicle adoption, renewable energy projects deployment, etc., owing to rapid industrialization and structural energy demand growth in emerging economies.

However, factors such as extended lead times, raw material shortages and surging costs, and labor shortages are acting as major restraints to global market growth, elevating total installed cost and complicating scheduling for utilities and transformer manufacturers operating under tightening environmental regulations and new regulatory mandates.

Market Dynamics

Drivers

The rapid global transition towards clean energy is significantly driving the demand for transformers as grids add variable generation and deploy smart grid technologies to maintain stability and energy efficiency. Renewable energy sources, particularly solar and wind farms, require reliable and efficient transmission and distribution infrastructure to integrate variable power generation into the grid, increasing the need for power transformer capacity at collector substations and distribution transformer upgrades near load centers.

Transformers play a critical role in stepping up the voltage for long-distance transmission and stepping it down for local distribution to end-users while minimizing transmission losses through optimized insulation, materials, and design.

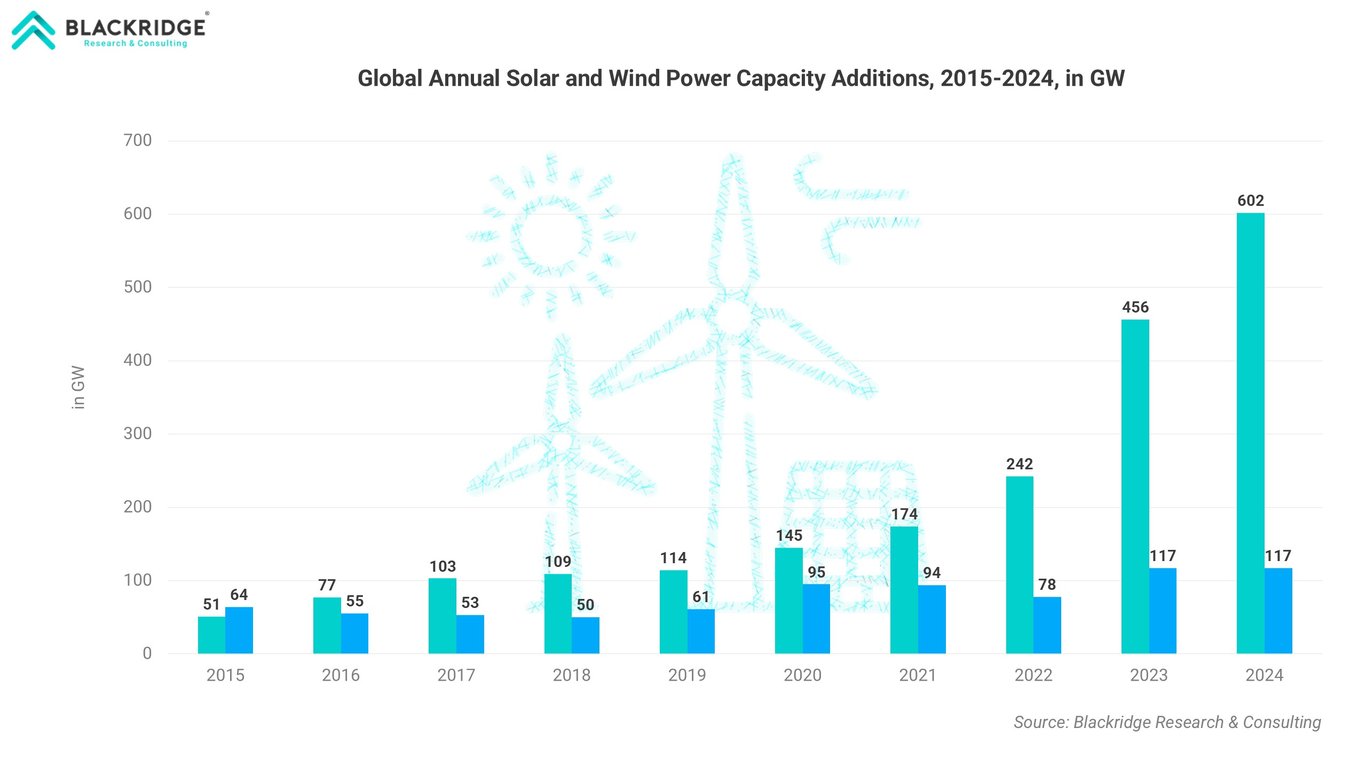

Globally, solar and wind power continue to dominate renewable energy capacity additions. In 2024 alone, around 602 GW of solar capacity and 117 GW of wind capacity were installed. With strong policy support and declining technology costs, these installations are projected to maintain robust growth throughout the forecast period.

Unlike conventional centralized power plants, renewable projects are often decentralized and geographically dispersed, which increases the need for additional substations, instrument transformer installations for metering and protection, and a broader mix of phase and voltage levels across various locations.

Moreover, utility-scale renewable installations such as offshore wind farms, solar parks, and hybrid renewable-plus-storage projects demand advanced grid and power transformers with higher capacity, improved insulation systems, and enhanced thermal design to raise efficiency and reliability.

Additionally, renewable energy integration requires grid modernization and digital monitoring systems. Smart transformers, capable of handling bidirectional power flows from distributed generation, are becoming indispensable as renewable energy penetration rises. This shift not only increases the volume demand for transformers but also accelerates the adoption of technologically advanced variants.

Restraints

The global transformer market faces a significant challenge due to the shortage and rising costs of critical raw materials, particularly grain-oriented electrical steel (GOES) and copper. These two commodities are essential for transformer cores and windings, making them non-substitutable inputs in manufacturing.

Any disruption directly affects production capacity, pricing, and delivery schedules, elongating lead times for transformer manufacturers across multiple voltage levels and power rating classes.

A major concern is the concentration of GOES production. Only a limited number of mills worldwide produce this specialized steel, and many of these producers are located in countries undergoing their own aggressive grid expansion programs. This creates a supply imbalance, as domestic demand in producing countries absorbs much of the available output, leaving a constrained volume for global exports.

The situation was further exacerbated during the COVID-19 pandemic, when manufacturers scaled back production in anticipation of declining demand. However, the subsequent surge in power infrastructure and energy infrastructure projects left suppliers unprepared, resulting in acute shortages and extended cycle times for power transformer and distribution transformer orders.

The volatility in the supply chain has pushed up raw material prices significantly. For example, copper prices have reached multi-year highs due to both demand growth and supply constraints. Similarly, GOES prices remain elevated due to limited production capacity. Since raw materials account for a substantial portion of transformer manufacturing costs, these price hikes directly translate into higher transformer prices, reducing affordability for utilities and the industrial sector.

The combined effect of supply bottlenecks, cost inflation, and longer delivery timelines creates substantial uncertainty in the market that can defer capital decisions, especially where regulatory mandates tighten procurement specs for energy efficiency and environmental performance.

This risks slowing deployments crucial for smart grid rollouts and electrification segments where transformers typically hold the largest market share of equipment spend within substations.

Market Opportunities

The global expansion of cloud computing, AI, and IoT is fueling a surge in data center construction. These facilities require extremely reliable power (99.99% uptime), driving sustained demand for transformers and related power quality solutions.

The EV industry’s rapid growth is creating massive demand for charging networks. Each new charging station requires transformers for grid connection, and government programs such as the U.S. NEVI initiative are injecting billions into this build-out, representing a large and growing market.

The expansion of semiconductor manufacturing, supported by initiatives like the CHIPS Act, is another significant opportunity. Semiconductor fabs are highly energy-intensive and require high-capacity, ultra-reliable transformers, generating steady demand for premium equipment.

Key Market Trends and Developments

Utilities are accelerating grid investments and interregional transmission, a key market trend that favors higher‑power rating units at elevated voltage levels to reduce transmission losses and meet rising electricity demand. For example, Dutch grid operator TenneT reached an agreement with APG, GIC, and NBIM on an equity investment to finance Germany’s high-voltage network expansion, valued at USD 46 billion.

Demand for smart transformers with IoT sensors and analytics is growing as smart grid programs mature, encouraging differentiated product launches focused on energy efficiency, digital monitoring, and lifecycle performance.

In September 2025, Brazilian motor maker WEG announced a USD 77 million investment in a U.S. specialty transformer manufacturing facility. The move aims to boost the plant’s production capacity by 50% to meet the surging demand driven by artificial intelligence in the country.

The new report from Blackridge Research on the Global Transformer Market comprehensively analyzes the Transformer Market and provides deep insight into the current and future state of the industry.

The study examines the drivers, restraints, and regional trends influencing Global Transformer Market demand and growth.

The report also addresses present and future market opportunities, market trends, developments, and the impact of geopolitics on the Transformer Market, important commercial developments, trends, regions, and segments poised for fastest growth; the competitive landscape; and the market share of key players.

Further, the report will also provide Transformer Market size, demand forecast, and growth rates.

What we Cover in the Report?

Transformer Market Drivers & Restraints

The study covers all the major underlying forces that help the market develop and grow and the factors that constrain the growth.

The report includes a meticulous analysis of each factor, explaining the relevant qualitative information with supporting data.

Each factor's respective impact in the near, medium, and long term will be covered using Harvey balls for visual communication of qualitative information and functions as a guide for you to analyze the degree of impact.

Transformer Market Analysis

This report discusses the overview of the market, latest updates, important commercial developments and structural trends, and government policies and regulations.

This section provides an assessment of geopolitics impact on Transformer Market demand.

Transformer Market Size and Demand Forecast

The report provides Global Transformer Market size and demand forecast until 2030, including year-on-year (YoY) growth rates and CAGR.

Transformer Market Industry Analysis

The report examines the critical elements of Transformer industry supply chain, its structure, and participants.

Using Porter's five forces framework, the report covers the assessment of the Transformer industry's state of competition and profitability.

Transformer Market Segmentation & Forecast

The report dissects the Global Transformer Market into various segments. A detailed summary of the current scenario, recent developments, and market outlook will be provided for each segment.

Further, market size and demand forecasts will be presented along with various drivers and barriers for individual market segments.

Effective market segmentation enables you to identify emerging trends and opportunities for long-term growth. Contact us for a "bespoke" market segmentation to better align the research report with your requirements.

Regional Market Analysis

The report covers detailed profiles of major countries across the world. Each country's analysis covers the current market scenario, market drivers, government policies & regulations, and market outlook.

In addition, market size, demand forecast, and growth rates will be provided for all regions.

Following are the notable countries covered under each region.

North America - United States, Canada, Mexico, and the Rest of North America

Europe - Germany, France, the United Kingdom (UK), Russia, and Rest of Europe

Asia-Pacific - China, India, Japan, South Korea, Australia, Rest of APAC

Rest of the world - Saudi Arabia, Brazil, Nigeria, South Africa, and other countries

Key Company Profiles

This report presents detailed profiles of Key market players in the Transformer industry such as General Electric, Schneider Electric, Mitsubishi Electric Corporation, etc. In general, each company profile includes - overview of the company, relevant products and services, a financial overview, and recent developments.

Competitive Landscape

The report provides a comprehensive list of notable companies in the market, including mergers and acquisitions (M&As), joint ventures (JVs), partnerships, collaborations, and other business agreements.

The study also discusses the strategies adopted by leading players in the industry.

Executive Summary

Executive Summary will be jam-packed with charts, infographics, and forecasts. This chapter summarizes the findings of the report crisply and clearly.

The report begins with an Executive Summary chapter and ends with Conclusions and Recommendations.

Get a free sample copy of the Global Transformer Market report by clicking the "Download a Free Sample Now!" button at the top of the page.

Table of Contents

This report helps to

Who needs this report?

What's included

Why buy this report?

Want to know about Current Offers?

Analyst access from Blackridge Research

Free Report Customization

Further Information

Common Questions

Single User License

The Single User License will provide access to only one user.

Team License

The Team License will provide access only up to 7 users. This is great for a team.

Corporate License

This Premium package is ideal for large companies. By having Corporate license, any employee of your organization or its subsidiaries can access the report. You will also receive free industry update after six months and also a white label powerpoint presentation.

Related Content

What people are saying about us

Haven’t found what you’re looking for?

More than 70% of our clients seek customized reports. Reach us out to get yours today!