Loading...

Market Research Reports

|Q4 2024

|Report ID: BR05307

|No. of Pages: 228

About this Report

The global lithium-ion battery market was valued at USD 201.3 billion in 2024 and is poised to grow rapidly over the forecast period. This growth is being supported by several factors, including the rising adoption of electric vehicles, declining battery costs, favorable government initiatives, and increasing deployment of energy storage solutions, along with other emerging applications across industries.

However, the geographical concentration of supply chains, critical mineral price volatility, delays in grid connections of battery energy storage systems (BESS), etc.,. are restraining the global market growth.

Market Definition

The global lithium-ion battery market refers to the industry focused on advanced rechargeable energy storage systems that power a wide range of applications, including electric vehicles, consumer electronics, grid-scale storage, medical devices, and industrial equipment, where matching the appropriate power capacity to each use case is essential for performance and reliability.

Within this landscape, selecting the right battery type ensures the optimal balance between output capability and endurance, aligning fast-charging, or long-duration storage needs with the most suitable cell chemistry.

The market encompasses key battery chemistries such as lithium iron phosphate (LFP), lithium titanate (LTO), lithium nickel cobalt aluminum oxide (NCA), lithium manganese oxide (LMO), lithium cobalt oxide (LCO), and nickel manganese cobalt (NMC batteries), which are valued for their high energy density, enhanced safety features, and long cycle life.

Current Market Scenario

The global lithium-ion battery industry is undergoing rapid growth and transformation, driven by surging demand from the energy sector, particularly electric vehicles (EVs) and BESS.

Lithium-ion battery technology is currently dominating the global battery market due to a significant cost decline since 2010, improved energy densities, and longer lifetimes. Within chemistries, lithium iron phosphate (LFP) is gaining traction for its lower cost, safety, and durability, while nickel-based chemistries (NMC, NCA) still dominate high-energy applications.

The concentration of supply chains in China is currently raising concerns about supply chain security, risks of overcapacity, and price volatility of key minerals, which may discourage new mining investments.

Governments are responding with strong policy initiatives such as India’s Production Linked Incentives (PLA) scheme and the EU’s Net Zero Industry Act to develop and strengthen domestic supply chains.

Drivers

Increasing Adoption of Electric Vehicles

The rapidly growing electric vehicle (EV) market is a primary driver of the global demand for lithium-ion batteries. EVs account for the majority of the lithium battery demand globally.

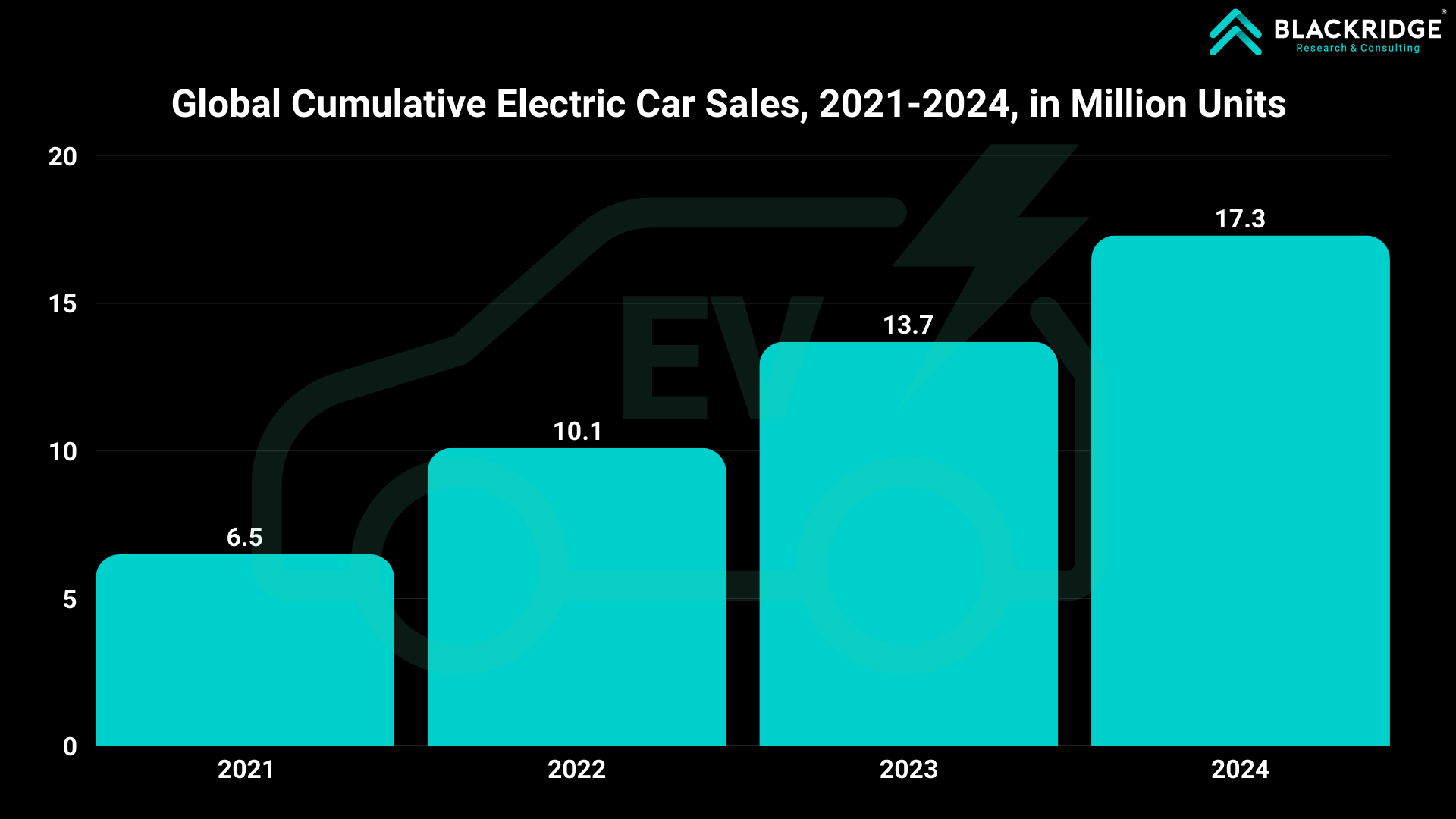

Global electric car sales exceeded 17 million in 2024, representing a sales share of more than 20% of all new cars sold worldwide. This 25% increase from the previous year meant that the additional 3.5 million electric cars sold in 2024 alone surpassed the total number of electric cars sold globally in 2020.

By the end of 2024, the global electric car fleet reached almost 58 million vehicles, which is approximately 4% of the total passenger car fleet and more than triple the fleet size in 2021.

Specifically, demand for EV batteries grew to over 950 GWh in 2024, an increase of 25% compared to 2023. Electric cars remain the primary factor behind this EV battery demand, accounting for over 85% of the demand.

With the increasing demand for electric vehicles, the demand for lithium ion batteries is expected to grow further during the forecast period.

Market Restraints

Geographical Concentration of Supply Chain

The battery supply chain, from raw material extraction to final battery pack assembly, exhibits a high degree of geographical concentration at almost every step. This concentration is particularly acute in specific regions and countries.

For instance, China undertakes well over half of global raw battery materials processing for lithium and cobalt. It also has a near monopoly on battery components production, supplying almost 85% of cathode active materials and over 90% of anode active material production, predominantly graphite.

While Indonesia controls most nickel refining, comprising around 60% of the global supply of battery-grade sulphate, China dominates the refining for nearly all other battery minerals.

The reliance on a small number of countries makes the entire supply chain vulnerable to individual country policy choices, company decisions, natural disasters, or technical failures. Recent events, such as Indonesia's 2020 prohibition of nickel ore exports and China's graphite export controls in December 2023, highlight this vulnerability.

China's proposed export limitations on battery cathode and lithium processing technologies further amplify these security concerns.

The high geographical concentration across the lithium-ion battery supply chain creates systemic vulnerabilities to geopolitical events and market fluctuations, leading to price volatility, higher production costs outside of dominant regions, and potential delays or failures in scaling up battery production.

These factors collectively impede the rapid expansion of the battery market, which is crucial for achieving global clean energy and climate goals.

Segment Analysis

By Application

The global lithium-ion battery market is now dominated by applications in electric mobility and battery energy storage, with consumer electronics playing a comparatively smaller role. Electric mobility has the largest market share, driven primarily by passenger cars. At the same time, demand from electric trucks and light-duty vehicles is rising rapidly.

battery storage has become the fastest-growing application, fueled by the need for grid stability and renewable energy integration, particularly in solar and wind power projects. Although consumer electronics continue to rely heavily on lithium-ion technology for devices such as smartphones and laptops, their share has diminished significantly as the market shifts toward large-scale energy transition and clean transportation solutions.

Regional Analysis

Asia-Pacific dominates the global lithium-ion battery market, with China leading by a wide margin across the entire supply chain—from raw material processing to battery cells and components. China alone accounts for the vast majority of global production capacity, supported by its competitive advantage in scale, integration, and cost efficiency, especially in LFP battery chemistry.

Alongside China, Korea and Japan are influential players, particularly in high-performance NMC chemistries and overseas investments. Emerging hubs like Indonesia and India are also drawing investment, with Indonesia leveraging its vast nickel reserves and India ramping up policy-driven efforts to develop domestic production.

Meanwhile, North America and Europe are working to expand their presence through supportive policies and foreign partnerships, though challenges like higher costs and weaker supply chain integration limit their competitiveness.

Recent Developments

In September 2025, Indian commercial vehicle manufacturer Ashok Leyland announced a INR 5,000 crore (~ USD 567 million) investment in battery manufacturing in partnership with China's CALB Group.

In September 2025, Japan’s TDK Corporation inaugurated its manufacturing plant in India. The facility can produce 200 million lithium battery packs annually.

China's CATL launched the TENER Stack in May 2025, the world's first 9 MWh ultra-large capacity energy storage system, aimed at AI data centers, industrial electrification, and grid stabilization.

In May 2025, Panasonic Corporation announced its decision to divest its solar and battery energy storage businesses.

In April 2025, LG Energy Solution unveiled plans for a joint venture with Derichebourg, France’s leading metal waste recycling company, to develop a battery recycling facility. The project is expected to break ground in 2026 in Bruyères-sur-Oise, in the Val-d’Oise region of northern France, with operations expected to begin in 2027.

The new report from Blackridge Research on the Global Lithium ion Battery Market comprehensively analyses the Global Lithium ion Battery Market and provides deep insight into the current and future state of the industry.

The study examines the market dynamics, and regional trends influencing Global Lithium ion Battery Market demand and growth.

The report also addresses present and future market opportunities, li ion battery market trends developments, and the impact of geopolitics on the Global Lithium ion Battery market, important commercial developments, trends, regions, and segments poised for fastest growth, the competitive landscape, and the market share of key players.

Further, the report will also provide Global Lithium ion Battery market size, demand forecast, and growth rates.

What Do We Cover in the Report?

Global Lithium ion Battery Market Drivers & Restraints

The study covers all the major underlying forces that help the market develop and grow and the factors that constrain growth.

The report includes a meticulous analysis of each factor, explaining the relevant, qualitative information with supporting data.

Each factor's respective impact in the near, medium, and long term will be covered using Harvey balls for visual communication of qualitative information and functions as a guide for you to analyze the degree of impact.

Global Lithium ion Battery Market Analysis

This report provides market overview, latest updates, important commercial developments and structural trends, and government policies and regulations.

Global Lithium ion Battery Market Size and Demand Forecast

The report provides Global Lithium ion Battery Market size and demand forecast until 2030, including year-on-year (YoY) growth rates and CAGR.

Global Lithium ion Battery Market Industry Analysis

The report examines the critical elements of the Global Lithium ion Battery industry supply chain, its structure, and participants.

Using Porter's five forces framework, the report covers the assessment of the Global Lithium ion Battery industry's state of competition and profitability.

Global Lithium ion Battery Market Segmentation & Forecast

The report dissects the global Lithium ion Battery market into various segments based on Lithium ion Battery cell application.

A detailed summary of the current scenario, recent developments, and market outlook will be provided for each segment.

Further, market size and demand forecasts will be presented, along with various drivers and barriers for individual market segments.

Effective market segmentation enables you to identify emerging trends and opportunities for long-term growth. Contact us for "bespoke" market segmentation to better align the research report with your requirements.

Regional Market Analysis

The report covers detailed profiles of major countries across the world. Each country's analysis covers the current market scenario, market drivers, government policies and regulations, and market outlook.

In addition, market size, demand forecasts, and growth rates will be provided for all regions and emerging markets.

Following are the notable countries covered under each region.

North America: United States, Canada, Mexico, and the Rest of North America

Europe: Germany, France, the United Kingdom (UK), and the Rest of Europe

Asia-Pacific: China, India, Japan, South Korea, Australia, and the Rest of APAC

Rest of the world: Middle East, Brazil, South Africa, and other countries

Key Company Profiles

This report presents detailed profiles of key lithium battery manufacturers in the global Lithium ion Battery market, such as CATL, CALB, Tesla Inc., Samsung SDI, LG Energy Solutions, BYD, Sungrow Power Supply Co., Ltd., Toshiba Corporation, Panasonic Corporation, GS Yuasa International Ltd., etc. In general, each company profile includes - overview of the company, relevant products and services, a financial overview, and recent developments.

Competitive Landscape

The report provides a comprehensive list of notable companies in the global market, including mergers and acquisitions (M&As), joint ventures (JVs), partnerships, collaborations, and other business agreements.

The study also discusses the strategies adopted by leading players in the industry.

Executive Summary

Executive summary will be jam-packed with charts, infographics, and forecasts. This chapter summarizes the findings of the report crisply and clearly.

The report begins with an Executive Summary chapter and ends with Conclusions and Recommendations.

Get a free sample copy of the Global Lithium ion Battery Market report by clicking the "Download a Free Sample Now!" button at the top of the page.

Table of Contents

This report helps to

Who needs this report?

What's included

Why buy this report?

Want to know about Current Offers?

Analyst access from Blackridge Research

Free Report Customization

Further Information

Common Questions

Single User License

The Single User License will provide access to only one user.

Team License

The Team License will provide access only up to 7 users. This is great for a team.

Corporate License

This Premium package is ideal for large companies. By having Corporate license, any employee of your organization or its subsidiaries can access the report. You will also receive free industry update after six months and also a white label powerpoint presentation.

Related Content

What people are saying about us

Haven’t found what you’re looking for?

More than 70% of our clients seek customized reports. Reach us out to get yours today!