Table of Contents

Are you someone looking to invest in solar in New Jersey? Homeowners and businesses here's all you need to know about solar incentives in New Jersey. With programs like SREC-II by state law and a 30% tax credit by federal law, thousands are shifting towards clean energy.

According to NJPBU (New Jersey Board of Public Utilities), as of March 2025, over 216,000 New Jersey homes and businesses have installed solar arrays, totaling over 5 GW capacity, which is more than double in the last seven years.

These figures demonstrate the major role of the NJ solar tax credit and several other NJ solar panel incentives that are helping homeowners and commercial projects save thousands of dollars every year.

Want to join thousands of homeowners and commercial project owners saving on solar installations? Navigating through incentives can be complex, but with experts like IncentiFind, you can avail maximum benefits. Keep reading to receive your key to unlock solar incentives in New Jersey!

Why 2025 is a Key Year for Solar Savings?

Are rising electricity bills disturbing your monthly budget? Want to reduce your electricity bill and also earn more through savings? New Jersey in 2025 is offering a never-before Return on Investment (ROI), but how is this year different?

Federal Solar Tax Credit (ITC/ITC)

The Federal Solar Tax Credit (Residential Clean Energy Credit) offers a 30% credit on the total cost of solar installation from the owners' federal taxes. Although the 30% credit is currently set to remain until 2032, there is significant discussion in Congress about potential changes.

A proposed legislative change passed by the U.S. House of Representatives aims to terminate the 30% Residential Clean Energy Credit on December 31, 2025. It is always important to consult a professional tax expert for advice on this financial incentive.

SuSI Program/ SREC II in NJ

Likewise, the Successor Solar Incentive (SuSI) Program, specifically the Administratively Determined Incentive (ADI) Program is a big boost for residential owners that offers fixed payments of USD 85 per SREC-II (Solar Renewable Energy Certificate II) for every 1 MWh of solar electricity your system generates which is guaranteed for 15 years.

While NJBPU plans to review the pricing in March 2026, investing in solar now can help you secure a favorable rate before this review.

Property Tax and Sales Exemption in NJ

Not just electricity bills, you can save on your property tax through state-specific property tax exemption that prevents your property taxes from increasing due to the added value of the solar system. Apart from property tax, all solar energy equipment is 100% exempt from state sales tax of 6.625%.

Now that you are likely convinced, let's dive into the incentives and how to apply them.

6 Ways Homeowners Can Maximize Savings on Solar Incentives in New Jersey (2025)

Saving 1: The Federal Solar Tax Credit (ITC)

What is it: The Federal Solar Investment Tax Credit (Residential Clean Energy Credit) allows you to claim 30% of your total solar panel installation cost. This includes the cost of panels, inverters, mounting, labor, permitting, and even qualifying battery storage systems.

How it Works: Since it's a tax credit, not a deduction, you can carry forward the unused portion of the tax credit to future tax years if your tax liability is not high enough.

Why 2025 is Critical: The House of Representatives has proposed a bill to terminate the 30% credit by December 31, 2025.

How to Avail: To claim this credit, you will fill out IRS Form 5695 when filing your federal taxes. This form allows you to claim your residential energy credits. It's crucial to consult with a qualified tax professional to understand how this incentive specifically applies to your financial situation.

Saving 2: New Jersey's Successor Solar Incentive (SuSI) Program – SREC-II Payments

What is it: This Incentive provides cash payments for the clean electricity produced from your solar system. For residential net-metered systems, this falls under the Administratively Determined Incentive (ADI) program.

How it Works: For every 1 MWh your solar system produces, you earn one SREC-II (Solar Renewable Energy Certificate II). Each SREC-II is valued at USD 85. These payments are guaranteed for 15 years from your system's interconnection date.

Why 2025 is Key: The NJBPU (New Jersey Board of Public Utilities) plans to review the pricing in March 2026. Installing your system now can help you secure this favorable USD 85 per SREC-II rate.

How to Avail: Your solar installer registers your solar system with the Generation Attribute Tracking System (GATS). This portal allocates a number to your solar system that tracks the solar energy produced and assigns one SREC-II for each MWh produced.

Later, this number is given to an SREC aggregator (like SRECTrade or Knollwood Energy) who will manage the selling of your SREC-IIs and deposit earnings directly into your bank account.

Saving 3: New Jersey's Solar Property Tax Exemption

What it is: While installing solar panels will increase your home's value, New Jersey offers a state-specific property tax exemption to ensure your taxes don't go up because of this added value.

How it Works: Under this exemption your property will not be taxed any additional value due to the added value of your solar system. You get all the benefits of an increased home value without any increase in your annual property tax bill.

How to Avail: You usually need to apply for a certificate from your local assessor's office to ensure this exemption is applied.

You could also apply for Certification of Renewable Energy Systems if you can find a direct, stable link from the NJ Division of Taxation.

Saving 4: New Jersey's Solar Sales Tax Exemption

What it is: This helps you save on solar installation right from the start. It is a tax exemption on all solar energy equipment.

How it Works: In New Jersey, all solar energy equipment purchased and installed is 100% exempt from the state's 6.625% sales tax.

For a typical solar system costing USD 25,000, this incentive allows you to save over USD 1,600!

How to Avail: Your solar installer will not charge you any sales tax on your solar equipment purchase.

Saving 5: Net Metering – Your "Solar Bank Account"

What it is: Net metering is a billing system that allows you to earn credits on the excess electricity generated from solar panels when sent to the grid.

How it Works: When your solar system produces more electricity than your home needs, this excess solar energy is sent to the grid which gives you a credit. For each kilowatt-hour (kWh) you earn a full retail credit of excess energy you send to the grid.

If your solar panels don’t generate sufficient electricity you can draw power from the grid using the credits earned earlier which will balance and cancel out from the electricity bill.

How to Avail: During solar installation, your installer will apply for a net meter for your solar system will be connected to the grid. Any unused credits are carried forward month-to-month within an annual billing cycle. If you still have excess credits at the end of the year, your utility will generally buy them back at a wholesale rate.

Bonus: New Jersey's full retail rate net metering ensures your excess solar energy is valued the same as the electricity you purchase, unlike California's NEM 3.0, where your excess solar energy is valued at a much lower wholesale rate.

Saving 6: Community Solar Energy Program (CSEP)

What it is: It program is for homeowners who rent, have shaded roofs, or live in multi-unit dwellings. The Community Solar Energy Program (CSEP) was introduced in New Jersey with new registrations opening in April 2025.

How it Works: It assures guaranteed savings of 15% or more on solar installations for low- and moderate-income (LMI) customers.

How to Avail: You can join a local community solar project through a project developer or aggregator. You will receive credits on the regular utility bill for the electricity generated on your off-site solar farm. The NJBPU's Community Solar Project Finder can help you locate projects in your locality.

Did You Know?

On average, homeowners claim USD 1,500 in rebate savings for implementing green measures.

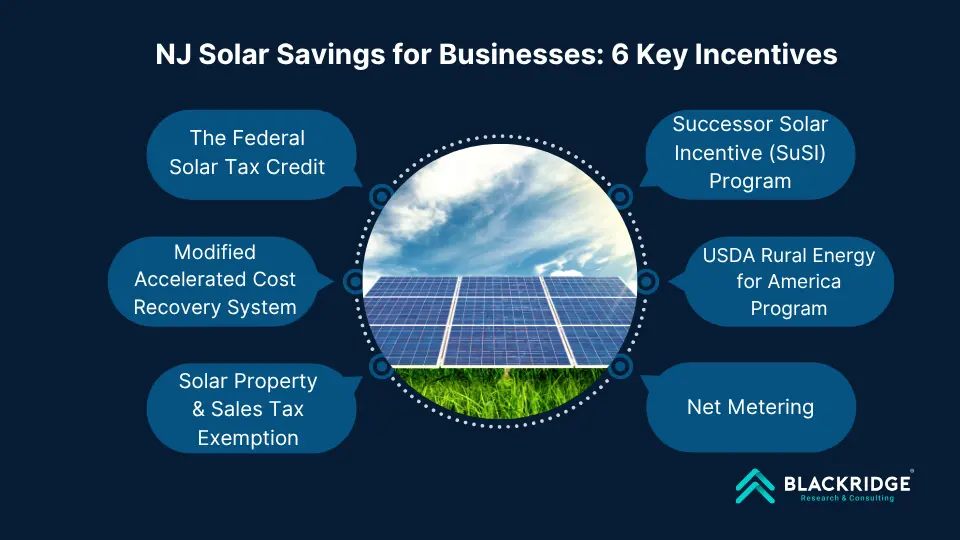

How Commercial Projects Can Maximize Savings on Solar Incentives in New Jersey (2025)

While homeowners benefit from NJ solar panel incentives, commercial project owners receive a whole different set of solar incentives in New Jersey. Here are 5 keys to your savings on commercial solar projects in New Jersey. Keep reading to unlock maximum savings and a bonus master key, exclusive to you!

Key 1: Federal Investment Solar Tax Credit (ITC)

What it is: The Federal Investment Solar Tax Credit (also known as the Energy Community Investment Credit), allows a baseline credit of 30% on the total solar installation cost which includes panels, inverters, mounting, labor, permitting, and qualifying battery storage. It is a tax credit against federal tax liability.

How it Works: This is a dollar-for-dollar reduction of your federal income tax. If your tax liability is not high enough to use a full tax credit you can carry forward the unused portion to future tax years, thus ensuring maximum savings coverage.

Why 2025 is Critical: The current US administration appears to be shifting focus towards fossil fuels away from renewable energy and the “adders” established under the ITC can help you achieve maximum savings of more than the baseline 30% if availed before the House of Representatives officially announces the termination of FTC by 31st December 2025.

How to Avail: To claim this credit, commercial project owners must file an IRS Form 3468, "Investment Credit.” It is important to consult with a qualified tax professional to understand how this tax credit specifically applies to your financial situation.

Key 2: Modified Accelerated Cost Recovery System (MACRS)

What it is: The Modified Accelerated Cost Recovery System (MACRS) is a federal tax incentive. Under this credit, qualifying solar energy equipment is eligible for a cost recovery of 5 years.

How it Works: The owner must reduce the project cost by depreciation. Currently, the bonus depreciation rate for solar systems is 40%, which means you deduct 40% as the bonus depreciation in the first year, and the remaining is depreciated over the subsequent years.

Important Note: When claiming both the ITC and MACRS, owners must reduce their depreciable basis by half of the ITC amount. For example, if your solar system costs USD 100,000 and the ITC is USD 30,000, your depreciable basis for MACRS would be reduced by half of the ITC (USD 15,000). So, you would depreciate USD 85,000 (USD 100,000 - USD 15,000) over the 5 years.

How to Avail: The project owner must file an IRS Form 4562, "Depreciation and Amortization," when filing their federal taxes. Consulting with a tax advisor is highly recommended to properly integrate MACRS depreciation with the ITC for optimal financial planning.

Key 3: New Jersey's SuSI Program (Successor Solar Incentive)

What it is: The Successor Solar Incentive (SuSI) Program is New Jersey's leading state-level incentive. This allows you to earn cash payments for every 1MWh of clean electricity your solar system produces.

How it Works: For every 1 MWh of electricity your solar system generates, you earn one SREC-II (Solar Renewable Energy Certificate II) just like for homeowners but here's how it's different for commercial projects:

Administratively Determined Incentive (ADI) Program: For smaller non-residential net-metered projects, such as rooftop, carport, canopy, and floating solar installations with a capacity under 5 MW, the SREC-II is applicable for a fixed 15 years ensuring a stable revenue generation.

Net-metered rooftop/carport/canopy/floating < 1 MW: USD 110 per SREC-II

Net-metered rooftop/carport/canopy/floating 1 MW to 5 MW: USD 100 per SREC-II

(Ground-mounted projects for certain sizes also have specific ADI rates.)

Competitive Solar Incentive (CSI) Program: This program applies to larger non-residential solar projects with a capacity of more than 5 MW. These projects participate in a bidding process where they compete for SREC-II values.

How to Avail: Your solar installer registers your solar system with the Generation Attribute Tracking System (GATS). This portal allocates a number to your solar system that tracks the solar energy produced and assigns one SREC-II for each MWh produced.

Later, this number is given to an SREC aggregator who will manage the selling of your SREC-IIs and deposit earnings directly into your bank account. For CSI projects the developer will handle the entire bidding process.

Key 4: USDA Rural Energy for America Program (REAP) Grants & Loans – For Rural Businesses

What it is: The USDA's REAP program provides solar benefits in the form of grants and loans for rural-based small businesses to purchase, install, and construct renewable energy systems.

How it Works: REAP grants a cover up to 50% for eligible projects, apart from grants it offers loan guarantees for small businesses to secure financing for their projects. Combined grant and loan guarantee funding is also offered.

Who Qualifies:

Rural small businesses living in a rural area with a population of 50,000 residents or less.

Agricultural producers must have at least 50% of gross income from agricultural operations), regardless of location.

How to Avail: Applications are submitted through the USDA Rural Development office. The application forms are available on the USDA Rural Development Portal. Currently, the Application Window is closed between 1st April to 30th June 2025.

Key 5: Solar Property Tax, Solar Sales Tax Exemption, and Net Metering

The solar project tax exemption, solar sales tax exemption, and Net Metering incentives are similar for both homeowners and commercial project owners. Check the homeowners' section.

With state and federal incentives, solar projects in New Jersey continue to reduce carbon footprint and provide valuable saving opportunities for both homeowners and businesses. However understanding each program and ensuring full compliance can be a complex process, expert guidance can streamline the process and ensure you capture extensive monetary benefits.

How to Apply for Solar Incentives in NJ [Step-by-Step]

Applying for different solar incentives can be confusing for beginners; each stage requires careful attention to detail. Here is a checklist to follow:

Step 1: Research about solar incentives in NJ

Step 2: Perform an eligibility check

Step 3: Pre-Construction Registration (Where required)

Step 4: Fill and Submit application form

Step 5: Secure permitting and interconnection

Step 6: Final documentation & incentive certification

Common Mistakes to Avoid When Applying for Solar Incentives in NJ

Even with a detailed checklist, solar incentive programs can lead to confusion and missed opportunities. Here are some common mistakes that can prevent you from maximizing your savings

Mistake 1: Missing Out on Lesser Known Incentives at Utility and Local Level.

Mistake 2: Errors in Application Forms

Mistake 3: Missing Out Deadlines for Specific Incentive Programs

Mistake 4: Misunderstanding Eligibility Criteria

Mistake 5: Lack of Proper Application Tracking

Mistake 6: Ignoring Program Changes

Bonus: Master Key To Unlock Maximum Solar Savings With IncentiFind

Navigate through forms, subsidies, incentives, and tax credits all in one go. If you're looking to unlock maximum solar savings with expert guidance, we got you covered!

Blackridge Research & Consulting has partnered with IncentiFind to help you maximize your savings through incentives, tax credits, and subsidies at federal, state, county, city, and utility levels.

Whether you are a homeowner or a commercial project owner, IncentiFind covers it all! You can search for incentives with a Quick Summary for free by registering, or get a customized VERIFY Report based on your incentive eligibility for home or business.

Don’t miss out on boosting your budget through significant ‘Savings’!

Summary

Solar energy incentives in New Jersey continue to offer a wide range of benefits for both homeowners and businesses. These incentives offer immense opportunities for investment in solar from small-scale utility projects to large-scale projects, navigating through the market requires expert assistance and a simplified process to avoid the risk of missing out on opportunities.

Because the solar market is dynamic and demands constant monitoring, staying ahead with comprehensive and real-time data becomes crucial to stay ahead of your competitors!

Track the Latest Solar Projects in the United States!

Subscribe to Blackridge’s US Solar Photovoltaic (PV) Projects Database and receive benefits like:

Access reliable and high-quality insights

Comprehensive list of upcoming, in-progress, and completed projects

Detailed stage-wise tracking for each project

Essential contact information of key stakeholders

Timely and regular updates to your inbox

Start a free demo to unlock new business opportunities!

Disclaimer:

This blog includes affiliate links, meaning we may earn a small commission if you buy through these links at no extra cost to you. Thank you for your support!

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.